Mergers and Acquisitions – Singapore Court Opines on the Revocability of SWIFT Code MT 103

Background

An MT103 is at times relied upon by sellers as an acceptable proof of payment in international M&A transactions. The need for an MT103 payment mechanism arises primarily from different circumstances of the buyer and the seller in the context of geographic locations, time zone differences and the desire of parties to have a transfer of title effected at the same time payment is made despite funds not actually having been received by the seller. In such cases, the delivery of a copy of the MT103 from the buyer to the seller will be a condition precedent to the transfer of title to the underlying assets being sold by the seller and is often relied upon as proof of payment made. This article considers the Singapore International Commercial Court’s (“SICC”) position in Malayan Banking Berhad v Barclays Bank PLC [2019] SGHC (I) 04 (“Malayan Banking”) regarding the revocability of an MT103, and the extent to which an MT103 may be considered as conclusive evidence of payment of monies.

Why this is important

Underlying the principle that MT103s are revocable until acted upon is a cautionary warning against the reliance placed on an MT103 as adequate proof of payment. A party which readily accepts an MT103 as proof of payment without verifying actual receipt of funds in its account and transfers title to assets in reliance of the MT103 faces the risk of non-payment if the MT103 is subsequently cancelled or not acted upon.

Background facts of Malayan Banking

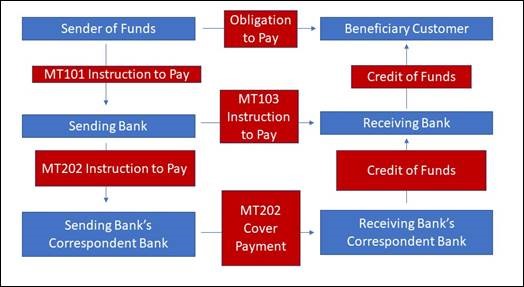

- Malayan Bank received instructions from Barclays Bank through an MT103 and proceeded to credit the beneficiary customer’s account. On the same day that the MT103 was sent, Barclays Bank also sent an MT202 cover payment instruction to Barclays NY, its correspondent bank, instructing Barclays NY to send payment to JP Morgan Chase, Malayan Bank’s correspondent bank. JP Morgan Chase will then credit the funds to Malayan Bank.

-

Subsequently, no payment or confirmation of payment was ever made to JP Morgan Chase by Barclays NY. This was because:

- Barclays Bank received information that the funds to be transferred by its customers had been received in questionable circumstances, and Barclays Bank then sought to cancel both the MT103 (to Malayan Bank) and the MT202 cover payment instruction (to Barclays NY).

- The request for cancellation of the MT202 cover payment instruction was received by Barclays NY which was still open and Barclays NY assented to the request.

- However, the request for cancellation of the MT103 was only received by Malayan Bank after closing hours in Singapore, by which time payment has already been made by Malayan Bank to the beneficiary customer’s account, in reliance on the MT103 which it received from Barclays Bank.

- Malayan Banking sought the beneficiary customer’s consent to refund the payment made but the customer refused, saying that the payment was made for a genuine business transaction.

- Malayan Bank, which was out of funds because it paid out on the MT103 but did not receive cover payment, sued Barclays Bank, alleging inter alia that there is an implied contract for reimbursement when it paid out the funds on the MT103

Diagram: Flow of instructions and funds in a payment transaction involving correspondent banking

The SICC Ruling in Obiter Dictum

Key Principles

- An MT103 is not merely payment information. It is a payment instruction which can be relied on and acted on to carry out the instructed transfer of credit.

- An MT103 however, like any other instruction which can be cancelled before implementation, can be revoked if it has not been acted upon by the party receiving the instruction.

- However, once payment is made on the instructions contained in an MT103, it is irrevocable and the obligation of the sending bank to reimburse the receiving bank is fully operative.

- If payment has not been made, there is no reason why a receiving bank should refuse a request for cancellation of the MT103.

Conclusion

- SICC’s obiter dictum and the expert evidence given in the case highlight certain shortcomings and risks associated with the traditional correspondent banking system and the practice of accepting an MT103 as adequate proof of payment.

- When deciding whether to accept an MT103 as proof of payment, the seller should consider the risk profile of the buyer, whether the buyer can be easily located, and the ease of mounting a claim against the buyer for recovery of funds. Often times, this is an uphill task for the seller, because the seller typically does not conduct due diligence on the buyer in an acquisition transaction. The significance of these issues are amplified if the buyer is an individual.

- When in doubt, the seller may wish to be in receipt of monies before transferring any sale assets, so as to avoid the risk of non-payment.

Eversheds Harry Elias Corporate Practice Group

The corporate practice group of Eversheds Harry Elias regularly provides advice on mergers and acquisitions, takeovers, private equity, venture capital, corporate reorganisations, corporate governance, both in Singapore and overseas. We have extensive experience and are well placed to offer corporate services to private companies operating in diverse industries, and in particular foreign companies wanting to set up base in Singapore and to venture into Asia.

For further information, contact:

|

||||||

|

Sze-Hui Goh Partner, Corporate, Eversheds Harry Elias sze-huigoh@eversheds-harryelias.com +65 6361 9828 Gerald Goh Of Counsel, Corporate, Eversheds Harry Elias geraldgoh@eversheds-harryelias.com +65 6361 9848 Janice Lim Legal Associate, Corporate, Eversheds Harry Elias janicelim@eversheds-harryelias.com +65 6361 9306 |