GLOBAL REGULATORY DEVELOPMENTS IN DIGITAL TOKENS

Increased Scrutiny in Singapore

The Monetary of Singapore released its Guide to Digital Token Offerings on 14 November 2017. Following which, it has taken steps to tighten its regulatory oversight over initial coin offerings (“ICO”). MAS has issued several advisories to warn consumers to act with extreme caution should they wish to invest in such products.

Recently, on 31 May 2018, MAS and the Commercial Affairs Department jointly released a statement advising the public to exercise “extreme caution” when dealing with unregulated online trading platforms.[1] Earlier, on 21 May 2018, MAS in a response on the Straits Times emphasised the importance of improving consumer awareness of the risks associated with investments in ICOs.[2]

These warnings have also translated into actual actions taken against errant exchanges and issuers. On 24 May 2018, MAS warned eight digital token exchanges in Singapore not to facilitate trading in digital tokens that are securities or futures contracts without MAS’ authorisation. It also warned an ICO issuer to stop the offering of its digital tokens in Singapore.[3]

MAS’ actions are consistent with the tightening in scrutiny by regulators across the globe.

Global Regulatory Developments

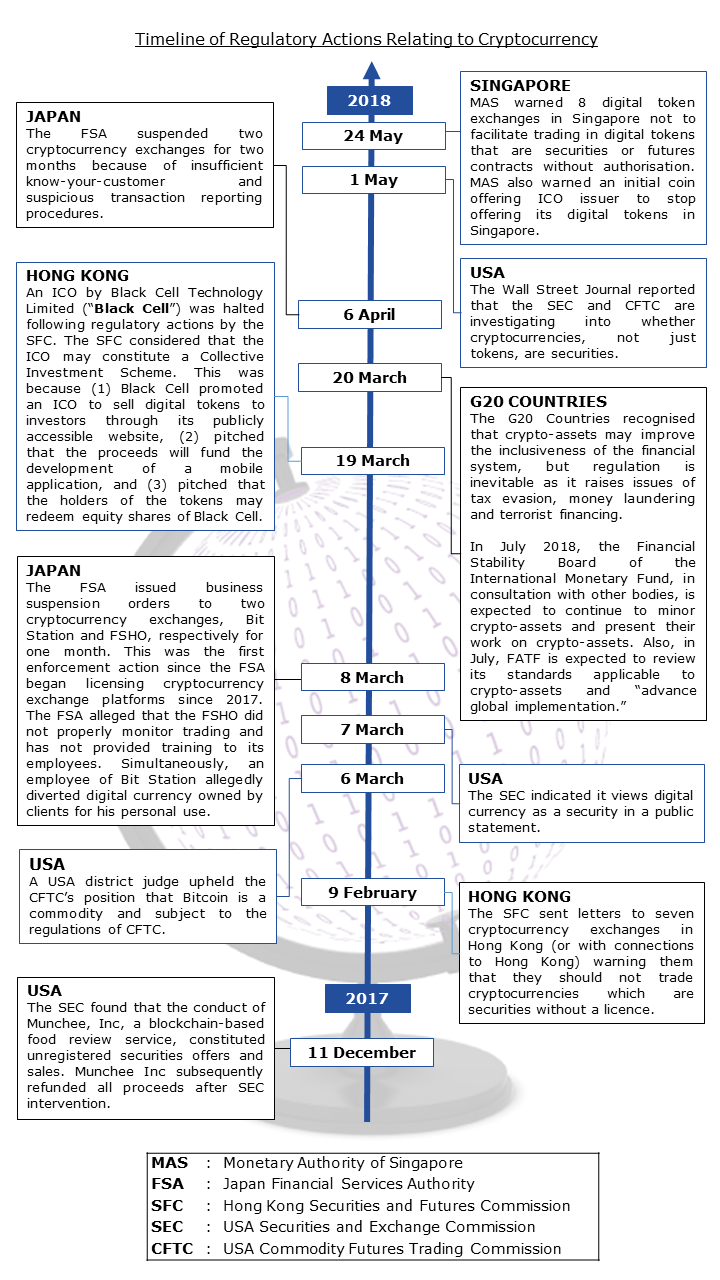

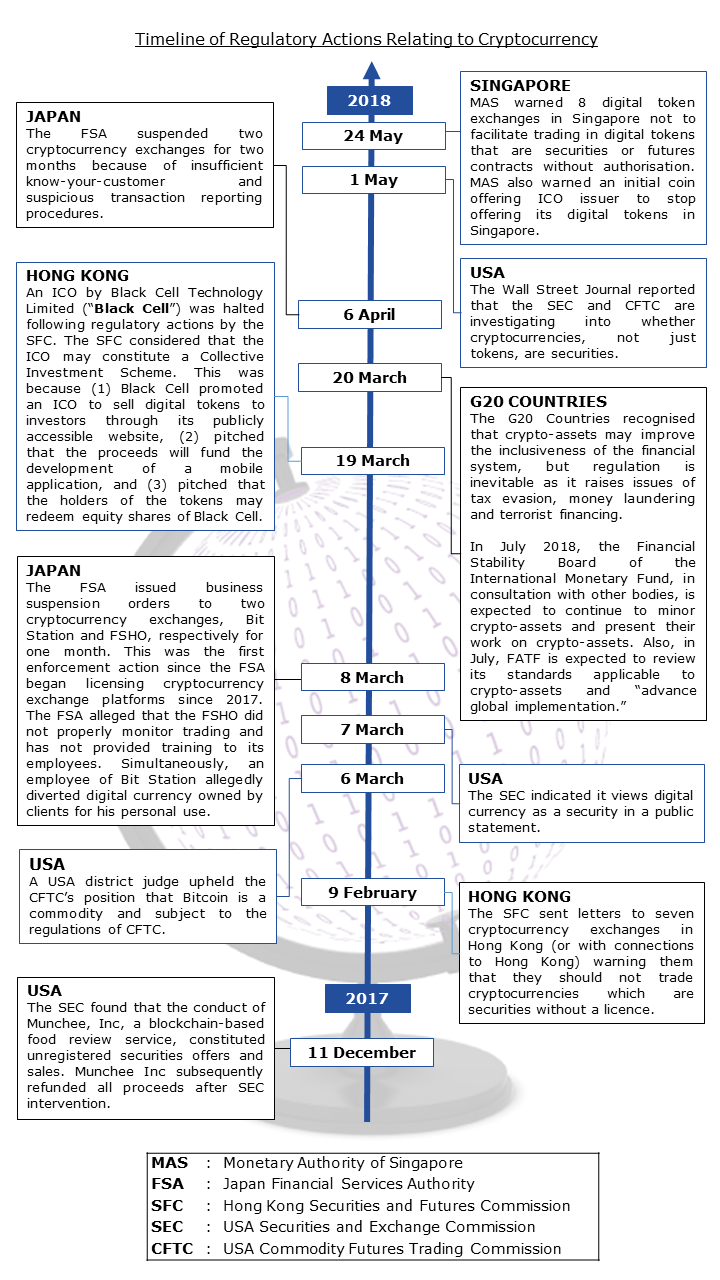

The G20 has put forward a July deadline for recommendations on how to regulate cryptocurrencies globally.[4] Countries such South Korea, the third largest nation to operate cryptocurrency markets, has also expressed that it is prepared to adopt the unified regulations.[5]

In USA, there is discussion on the possible classification of cryptocurrencies as securities, and not tokens or commodities. The Securities and Futures Commission has also been active in bringing regulatory actions against industry players.

The Swiss Financial Market Supervisory Authority has also published ICO guidelines in February earlier this year, taking the view that asset tokens likely constitute securities while payment tokens and utility tokens unlikely classified as securities, although further analysis is required.

Japan’s Financial Security Agency is banning private cryptocurrencies and will not allow cryptocurrencies that provide anonymity. After approving 16 cryptocurrency exchanges since regulations came into effect in April 2017, Japan has also issued its first rejection of an application on June 2018.[6]

Closer to home, in Hong Kong, the Securities and Futures Commission has also been emphasising the risks of using cryptocurrency and requesting that alerting investors of the risks associated. Regulatory action was also taken as it halted Black Cell Technology Limited’s initial coin offering in March 2018.[7]

Further developments are summarised in the timeline below.

Singapore’s Payment Services Bill

Singapore’s Payment Services Bill

In Singapore, it is apposite to note that while digital tokens may not constitute securities, they are not free from all forms of regulation. In particular, the Payment Services Bill contemplates that companies dealing with virtual currencies may soon be required to obtain a payment services licence and comply with anti-money laundering and counter terrorist financing rules.

Moving Forward

The question then is, in view of such developments, what would the Singapore regulatory position be? MAS has emphasised that it would not be restricting bona fide businesses, however, if any digital token exchange, issuer or intermediary breaches Singapore’s securities law, “firm action” would be taken. The responsibility lies with such digital token issuers, intermediaries and platforms to comply with all relevant laws.

Given the quick-changing regulatory landscape, companies should exercise caution in merely relying on legal opinions in making offerings of digital tokens. Weight must be accorded to the regulatory risk considerations that shape this landscape, in order to structure a sustainable business model. The industry should not expect that this volatile space would be unregulated – as we have seen in Singapore, it is likely that such digital tokens be regulated, whether through the Payment Services Act when gazetted, under the current Securities regime or by another stand-alone statute balancing the position that MAS has taken towards supporting “legitimate businesses”.

Author:

Claudia Teo,

Partner & Head, Corporate and Financial Services, Eversheds Harry Elias LLP

[1] Monetary Authority of Singapore, “CAD and MAS warn investors about trading on unregulated online platforms” (http://www.mas.gov.sg/News-and-Publications/Media-Releases/2018/CAD-and-MAS-warn-investors-about-trading-on-unregulated-online-platforms.aspx), 31 May 2018

[2] Monetary Authority of Singapore, “Response to Do more to warn the public of risks of initial coin offerings” (http://www.mas.gov.sg/News-and-Publications/Letters-to-Editor/2018/Do-more-to-warn-public-of-risks-of-initial-coin-offerings.aspx), 21 May 2018

[3] Monetary Authority of Singapore, “MAS warns Digital Token Exchanges and ICO Issuer”, (http://www.mas.gov.sg/News-and-Publications/Media-Releases/2018/MAS-warns-Digital-Token-Exchanges-and-ICO-Issuer.aspx), 24 May 2018

[4] Coin Telegraph, “G20 and Cryptocurrencies: Baby Steps Towards Regulatory Recommendations” (https://cointelegraph.com/news/g20-and-cryptocurrencies-baby-steps-towards-regulatory-recommendations), 21 Mar 2018

[5] BC Focus, “G20 Regulations on Cryptocurrency to be adopted by South Korea” (https://bcfocus.com/news/g20-regulations-on-cryptocurrency-to-be-adopted-by-south-korea/9541/), 19 May 2018

[6] The Mainichi, “Japan Financial Watchdog Denies Approval of Cryptocurrency Exchange” (https://mainichi.jp/english/articles/20180608/p2g/00m/0bu/003000c), 8 Jun 2018

[7] Asia Times, “Cryptos Rise as Hong Kong Regulators Apply the Brakes” (http://www.atimes.com/article/cryptos-rise-as-hong-kong-regulators-apply-the-brakes/), 18 May 2018